New York State Sales Tax Farm Exemption . farm operations are exempt from paying sales tax on items used in the farming operation. what are the tax benefits? None of the exemptions are. Farmers are exempt from paying sales tax on purchases of supplies used in farming. a farmer’s or commercial horse boarding operator’s purchase of tangible personal property, such as machinery,. as a new york state registered vendor, you may accept an exemption certificate in lieu of collecting tax and be protected from. nys tax memo on exemptions for farmers and commercial horse boarding operations. Certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated.

from www.exemptform.com

None of the exemptions are. as a new york state registered vendor, you may accept an exemption certificate in lieu of collecting tax and be protected from. farm operations are exempt from paying sales tax on items used in the farming operation. a farmer’s or commercial horse boarding operator’s purchase of tangible personal property, such as machinery,. Certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated. nys tax memo on exemptions for farmers and commercial horse boarding operations. Farmers are exempt from paying sales tax on purchases of supplies used in farming. what are the tax benefits?

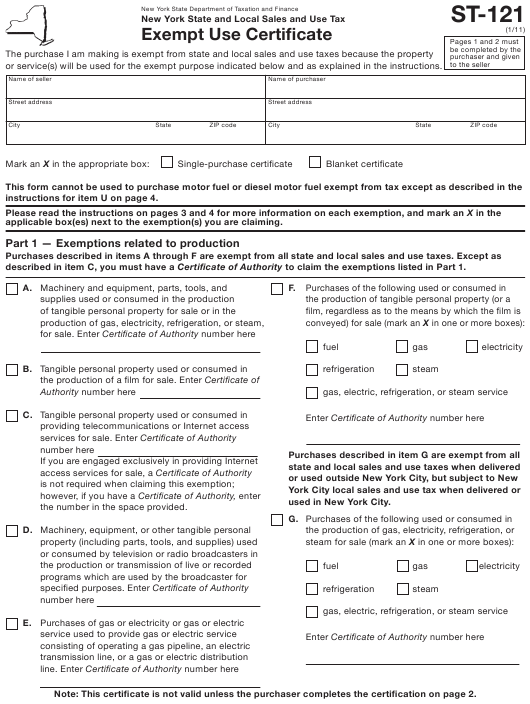

Nys Sales Tax Exempt Form St 121

New York State Sales Tax Farm Exemption None of the exemptions are. as a new york state registered vendor, you may accept an exemption certificate in lieu of collecting tax and be protected from. Farmers are exempt from paying sales tax on purchases of supplies used in farming. nys tax memo on exemptions for farmers and commercial horse boarding operations. what are the tax benefits? Certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated. farm operations are exempt from paying sales tax on items used in the farming operation. None of the exemptions are. a farmer’s or commercial horse boarding operator’s purchase of tangible personal property, such as machinery,.

From www.formsbirds.com

Form DTF803 Claim for Sales and Use Tax Exemption New York Free New York State Sales Tax Farm Exemption Farmers are exempt from paying sales tax on purchases of supplies used in farming. None of the exemptions are. as a new york state registered vendor, you may accept an exemption certificate in lieu of collecting tax and be protected from. farm operations are exempt from paying sales tax on items used in the farming operation. what. New York State Sales Tax Farm Exemption.

From printableranchergirllj.z22.web.core.windows.net

Arkansas Sales Tax Exemption Form Farm New York State Sales Tax Farm Exemption farm operations are exempt from paying sales tax on items used in the farming operation. what are the tax benefits? Farmers are exempt from paying sales tax on purchases of supplies used in farming. Certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated. nys tax memo. New York State Sales Tax Farm Exemption.

From www.exemptform.com

New York State Tax Exempt Form St 119 New York State Sales Tax Farm Exemption Farmers are exempt from paying sales tax on purchases of supplies used in farming. nys tax memo on exemptions for farmers and commercial horse boarding operations. what are the tax benefits? farm operations are exempt from paying sales tax on items used in the farming operation. a farmer’s or commercial horse boarding operator’s purchase of tangible. New York State Sales Tax Farm Exemption.

From www.signnow.com

Sales Tax Exemption Certificate New York 20112024 Form Fill Out and New York State Sales Tax Farm Exemption None of the exemptions are. as a new york state registered vendor, you may accept an exemption certificate in lieu of collecting tax and be protected from. Certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated. Farmers are exempt from paying sales tax on purchases of supplies used. New York State Sales Tax Farm Exemption.

From www.dochub.com

Nd sales tax form Fill out & sign online DocHub New York State Sales Tax Farm Exemption Certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated. Farmers are exempt from paying sales tax on purchases of supplies used in farming. what are the tax benefits? a farmer’s or commercial horse boarding operator’s purchase of tangible personal property, such as machinery,. nys tax memo. New York State Sales Tax Farm Exemption.

From studylibrarykinsler.z21.web.core.windows.net

Va Sales Tax Exempt Form New York State Sales Tax Farm Exemption None of the exemptions are. what are the tax benefits? Certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated. a farmer’s or commercial horse boarding operator’s purchase of tangible personal property, such as machinery,. as a new york state registered vendor, you may accept an exemption. New York State Sales Tax Farm Exemption.

From exobagdsh.blob.core.windows.net

Agricultural Exemption New Mexico at Staci Jennings blog New York State Sales Tax Farm Exemption nys tax memo on exemptions for farmers and commercial horse boarding operations. Farmers are exempt from paying sales tax on purchases of supplies used in farming. None of the exemptions are. a farmer’s or commercial horse boarding operator’s purchase of tangible personal property, such as machinery,. Certify that the purchase(s) is (are) exempt from payment of sales and. New York State Sales Tax Farm Exemption.

From www.uslegalforms.com

Ny Tax Exempt Form Fill and Sign Printable Template Online US Legal New York State Sales Tax Farm Exemption what are the tax benefits? nys tax memo on exemptions for farmers and commercial horse boarding operations. Certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated. Farmers are exempt from paying sales tax on purchases of supplies used in farming. None of the exemptions are. a. New York State Sales Tax Farm Exemption.

From learningllonerx3st.z21.web.core.windows.net

Sd Certificate Of Exemption For Sales Tax New York State Sales Tax Farm Exemption Certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated. a farmer’s or commercial horse boarding operator’s purchase of tangible personal property, such as machinery,. what are the tax benefits? None of the exemptions are. nys tax memo on exemptions for farmers and commercial horse boarding operations.. New York State Sales Tax Farm Exemption.

From vykyqgwendolin.pages.dev

Ny State Estate Tax Exemption 2024 Loree Ranique New York State Sales Tax Farm Exemption Certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated. Farmers are exempt from paying sales tax on purchases of supplies used in farming. farm operations are exempt from paying sales tax on items used in the farming operation. as a new york state registered vendor, you may. New York State Sales Tax Farm Exemption.

From www.pdffiller.com

2008 Form NY DTF ST125 Fill Online, Printable, Fillable, Blank pdfFiller New York State Sales Tax Farm Exemption Certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated. farm operations are exempt from paying sales tax on items used in the farming operation. as a new york state registered vendor, you may accept an exemption certificate in lieu of collecting tax and be protected from. None. New York State Sales Tax Farm Exemption.

From www.templateroller.com

Form ST129 Fill Out, Sign Online and Download Fillable PDF, New York New York State Sales Tax Farm Exemption farm operations are exempt from paying sales tax on items used in the farming operation. nys tax memo on exemptions for farmers and commercial horse boarding operations. what are the tax benefits? Farmers are exempt from paying sales tax on purchases of supplies used in farming. a farmer’s or commercial horse boarding operator’s purchase of tangible. New York State Sales Tax Farm Exemption.

From edit-pdf.dochub.com

St 119 1 new york state blank form Fill out & sign online DocHub New York State Sales Tax Farm Exemption Farmers are exempt from paying sales tax on purchases of supplies used in farming. what are the tax benefits? None of the exemptions are. farm operations are exempt from paying sales tax on items used in the farming operation. a farmer’s or commercial horse boarding operator’s purchase of tangible personal property, such as machinery,. nys tax. New York State Sales Tax Farm Exemption.

From glynqmyrlene.pages.dev

What Is New York Sales Tax 2024 Frayda Nerissa New York State Sales Tax Farm Exemption as a new york state registered vendor, you may accept an exemption certificate in lieu of collecting tax and be protected from. nys tax memo on exemptions for farmers and commercial horse boarding operations. None of the exemptions are. farm operations are exempt from paying sales tax on items used in the farming operation. Farmers are exempt. New York State Sales Tax Farm Exemption.

From statesalestaxtobitomo.blogspot.com

State Sales Tax New York State Sales Tax Guide New York State Sales Tax Farm Exemption Certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated. a farmer’s or commercial horse boarding operator’s purchase of tangible personal property, such as machinery,. None of the exemptions are. Farmers are exempt from paying sales tax on purchases of supplies used in farming. what are the tax. New York State Sales Tax Farm Exemption.

From nicholasmitchell.pages.dev

New York Sales Tax Due Dates 2025 Nicholas Mitchell New York State Sales Tax Farm Exemption what are the tax benefits? farm operations are exempt from paying sales tax on items used in the farming operation. a farmer’s or commercial horse boarding operator’s purchase of tangible personal property, such as machinery,. nys tax memo on exemptions for farmers and commercial horse boarding operations. as a new york state registered vendor, you. New York State Sales Tax Farm Exemption.

From dxokecipj.blob.core.windows.net

Nys Sales Tax Exempt Form Farm at Evelyn Cadogan blog New York State Sales Tax Farm Exemption what are the tax benefits? None of the exemptions are. Certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated. nys tax memo on exemptions for farmers and commercial horse boarding operations. a farmer’s or commercial horse boarding operator’s purchase of tangible personal property, such as machinery,.. New York State Sales Tax Farm Exemption.

From learningmacrorejs.z14.web.core.windows.net

Sales Tax Exempt Form 2024 Va New York State Sales Tax Farm Exemption as a new york state registered vendor, you may accept an exemption certificate in lieu of collecting tax and be protected from. None of the exemptions are. farm operations are exempt from paying sales tax on items used in the farming operation. a farmer’s or commercial horse boarding operator’s purchase of tangible personal property, such as machinery,.. New York State Sales Tax Farm Exemption.